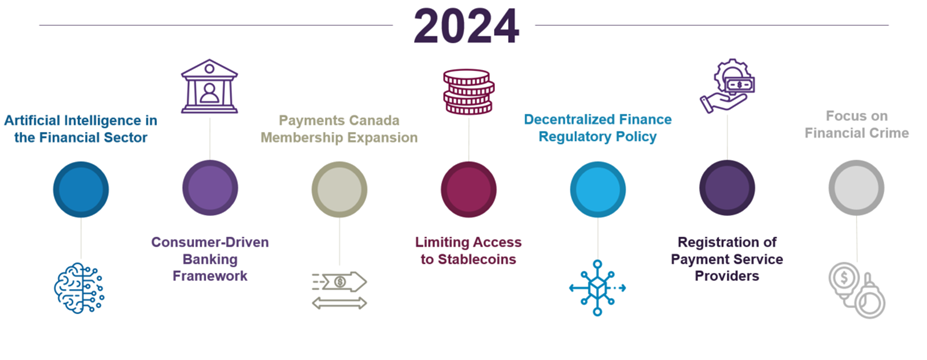

As we move into 2024, Gowling WLG’s Financial Services and Technology (FSxT) Group shares its take on key legal and regulatory developments expected to affect the Canadian market this year:

Regulating artificial intelligence (AI) in the financial sector

We expect that the Artificial Intelligence and Data Act (AIDA), a component of the Digital Charter Implementation Act, 2002 (Bill C-27), will become law this year, after continued refinement through the legislative process. If passed, AIDA will be a national general-purpose legislation regulating AI. We anticipate various federal and provincial regulators to also consider additional industry-specific regulations over time. In the case of the Office of the Superintendent of Financial Institutions (OSFI), it will continue its inquiry into how the institutions that it regulates are using AI, building upon its industry survey distributed in late 2023, and its public consultation on draft Guideline E-23: Model Risk Management. Look out for further developments from OSFI this year flowing from this work.

Advancing consumer-driven banking (open banking)

The 2023 Fall Economic Statement announced that the federal government will introduce legislation through Budget 2024 to establish a consumer-driven banking framework that would regulate access to financial data. The framework is anticipated to ensure that Canadians and small businesses have safe and secure access to financial services and products that help them manage and improve their finances. Budget 2024 is expected to be released in March setting the stage for what the legislation will encompass, while the legislation itself is expected to be released in the fall in connection with a second budget implementation act.

Limiting access to stablecoins

In an October 2023 Staff Notice, the CSA underscored its expectations that registered crypto trading platforms would stop allowing clients to buy or deposit value-reference crypto assets, commonly referred to as "stablecoins," that are not "fiat backed" by Dec. 29, 2023. Additionally, crypto trading platforms are expected to no longer allow their clients to buy or deposit stablecoins that are "fiat-backed" unless a number of conditions are met by April 30, 2024. Among these conditions are the requirements that these coins reference the value of only the Canadian or U.S. dollar on a one-to-one basis and that reserves are backed by audited, specified "real-world" assets (like cash and regulated money-market funds) measured at fair value and held with a qualified custodian.

Expanding Payments Canada membership

The Canadian government plans to update the Canadian Payments Act this year to allow more types of financial institutions to join Payments Canada. This change aims to reduce transaction costs and enhance the speed and security of payments for Canadians.

Registration required for retail payment service providers

Payment service providers (PSPs) regulated under the Retail Payment Activities Act (RPAA) must submit a registration application with the Bank of Canada by November 15, 2024. Further details of the Bank of Canada's registration requirements and processes under the RPAA are expected in early 2024. During this time, the Bank is also expected to test its registration process and identify areas of improvement before provisions of the RPAA come into force.

Developing decentralized finance (DeFi) regulatory policy

The International Organization of Securities Commissions (IOSCO) finalized its policy recommendations for DeFi in December 2023. The nine recommendations developed by IOSCO's DeFi Working Group primarily aim to address market integrity and investor protection concerns in key areas such as risk identification, comprehensive disclosure and cross-border cooperation. The DeFi Working Group included members of the Ontario Securities Commission and Quebec Autorité des Marchés Financiers. We expect that these recommendations will be taken into consideration by Canadian securities commissions in reviewing DeFi arrangements in 2024.

Continued focus on financial crime

Following a public consultation on Canada's anti-money laundering and anti-terrorist financing legislative and regulatory framework in 2023, we expect to see further changes to strengthen and modernize this area in 2024. Specifically, we anticipate a continued focus on the growth of the Financial Transactions and Reports Analysis Centre of Canada's (FINTRAC) role as Canada's financial intelligence unit and anti-money laundering and anti-terrorist financing supervisor.

For any questions you may have about these topics, please contact one of the authors.